The venture capital landscape for AI and robotics startups has experienced unprecedented growth in 2025, with AI dominating investment flows and robotics showing strong recovery after previous market contractions.

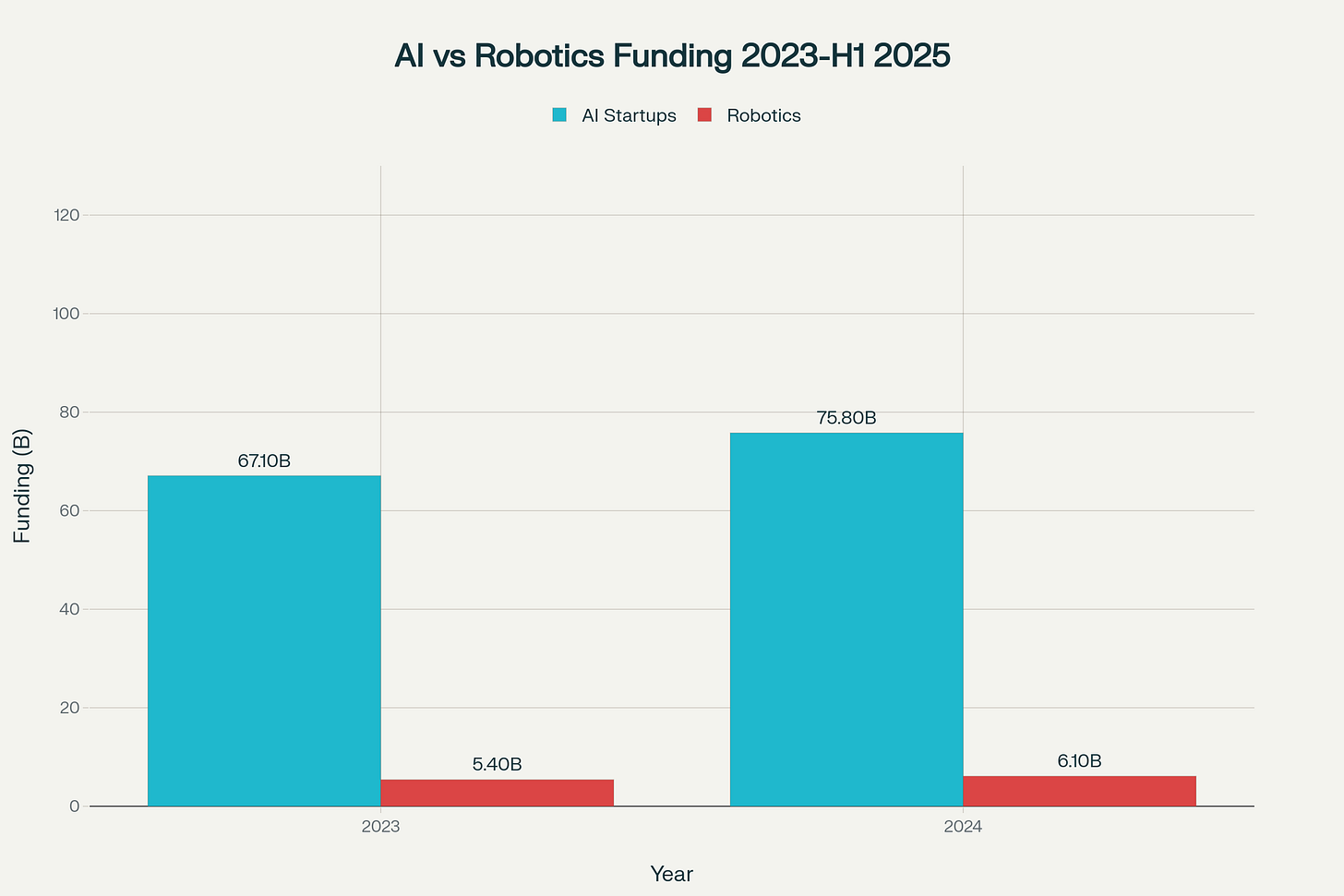

Global funding growth for AI and Robotics startups from 2023 to H1 2025

AI startups have reached historic funding levels, with global investments of $122 billion in the first half of 2025 alone, representing a 17.2% year-over-year increase. This surge positions AI to capture nearly half of all venture capital deployed, with 49.2% of total VC deal value in Q2 2025 going to AI companies. The US market leads this growth, attracting 85.5% of global AI funding ($104.3 billion).govclab+1

Robotics startups are experiencing a renaissance, raising over $6 billion globally in H1 2025, marking a 19% increase from the previous year. This recovery comes after robotics investment had cratered to five-year lows in 2023, demonstrating renewed investor confidence in automation and physical AI applications.link.springer+2

The convergence of AI and robotics has created particularly strong investment momentum, with AI-powered robotics companies attracting premium valuations and mega-rounds. Humanoid robotics has emerged as a standout category, with companies like Figure AI and Apptronik raising hundreds of millions at multi-billion dollar valuations.aventis-advisors+1

Valuation Metrics and Benchmarks

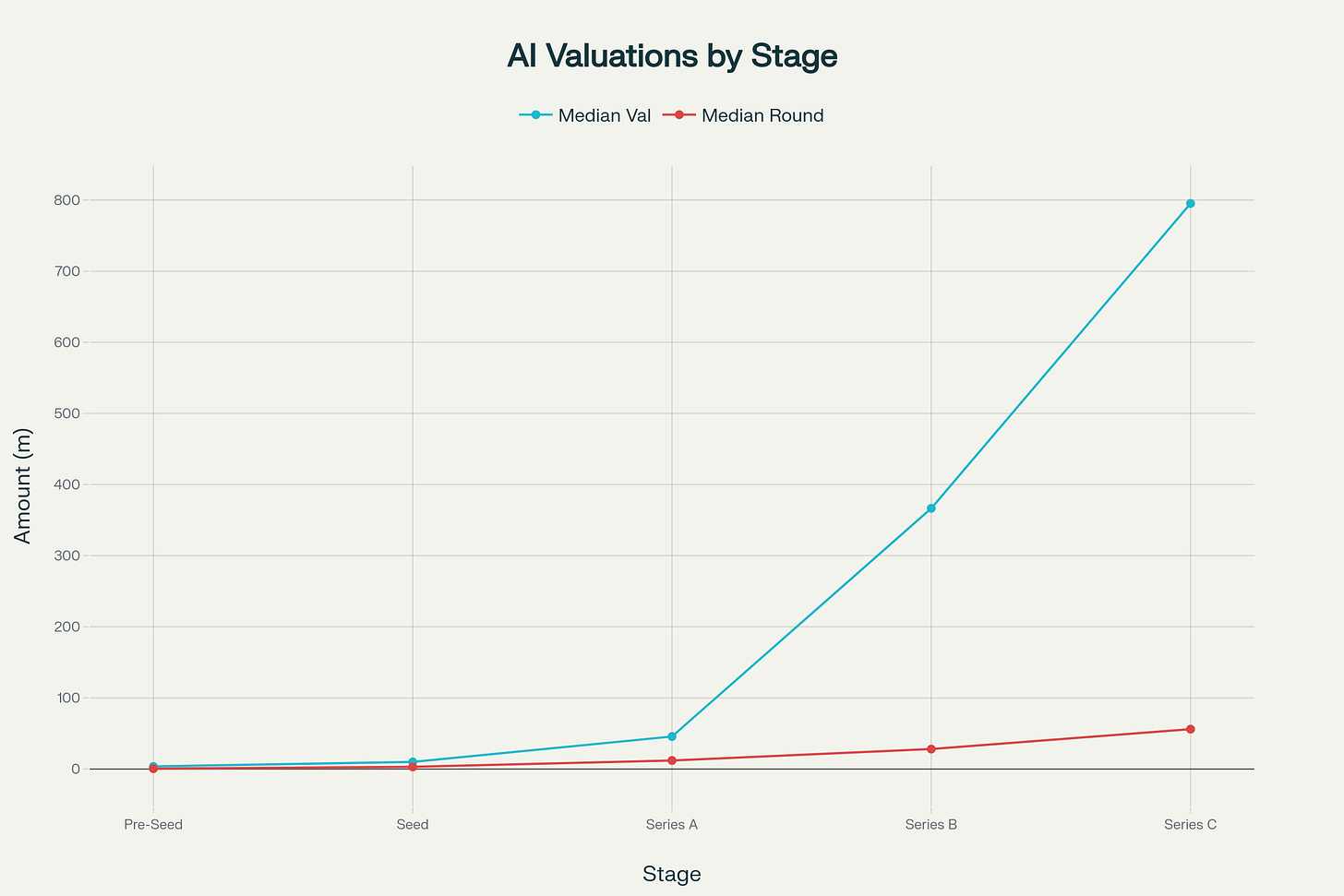

AI startup valuation progression by funding stage in 2025

AI startup valuations have reached new heights across all funding stages, with significant premium multiples compared to traditional SaaS companies. Pre-seed AI startups now command median pre-money valuations of $3.6 million, while Series C companies average $795.2 million.finrofca+1

Revenue multiples for AI startups vary dramatically by stage and performance:

Early-stage AI startups: 10x-50x revenue multiplessganalytics

Growth-stage AI startups: 8x-20x revenue multiplessganalytics

Mature AI startups: 5x-12x revenue multiplessganalytics

Robotics companies face different valuation dynamics, with public robotics companies showing a median revenue multiple of 7x, though this ranges from 1x to over 100x depending on growth stage and market position. The hardware component creates longer development cycles and higher capital requirements, often justifying extended runways but requiring different investor expectations.reuters+1

Key valuation drivers include proprietary technology strength, data quality and defensibility, regulatory compliance readiness, and clear paths to profitability. Investors are increasingly moving beyond speculative hype toward financial sustainability and commercialization strategies.sganalytics

valuation_metrics.csv

Critical KPI Benchmarks

Financial Performance Metrics

Monthly and Annual Recurring Revenue: AI startups typically target $100K-$1M+ in MRR and $1.2M-$12M+ in ARR, while robotics startups need higher thresholds of $150K-$2M+ MRR and $1.8M-$24M+ ARR due to hardware complexity. For Series A funding, the new benchmark has risen to approximately $3 million ARR, doubling from previous years.reuters+1

Gross Margins: AI startups typically achieve 50-60% gross margins due to compute and infrastructure costs, significantly lower than traditional SaaS companies that often exceed 75%. Robotics startups face even greater challenges with 30-50% gross margins due to hardware manufacturing and component costs.reuters

Burn Rate and Cash Efficiency: AI startups maintain higher baseline burn rates due to talent costs, compute infrastructure, and R&D investments. The burn rate multiple (net burn ÷ net new ARR) should ideally stay between 1-2x for AI companies and 1.5-3x for robotics companies, with anything above 2x requiring improvement focus.moonfare+1

Growth and Customer Metrics

Revenue Growth: AI startups target 15-25% monthly revenue growth, while robotics companies typically achieve 10-20% due to longer sales cycles and implementation complexity. The median time for AI startups to reach $5 million annualized revenue is now 24 months, 35% faster than previous SaaS benchmarks.reuters+1

Customer Acquisition Cost (CAC): AI startups see CAC ranges of $5K-$50K, while robotics companies face higher $10K-$100K acquisition costs due to complex B2B sales processes and longer evaluation periods.

kpi_benchmarks.csv

kpi_benchmarks.csv

Generated File

The CAC ratio continues rising, with companies now spending $2.00 in sales and marketing to acquire $1.00 of new customer ARR.finerva

Customer Retention: AI companies target churn rates below 5%, while robotics companies can accept slightly higher rates up to 8% due to the stickiness advantage of hardware implementations. Net revenue retention has become challenging, with median rates at 101%, highlighting difficulties in expanding existing customer relationships.finerva

Due Diligence Framework

due_diligence_focus.csv

due_diligence_focus.csv

Generated File

Technical Assessment Priorities

For AI startups, investors focus intensively on model accuracy, data quality, and compute efficiency as critical technical differentiators. AI-powered due diligence tools now help VCs analyze vast amounts of technical documentation, with 40% improvement in red flag identification and ability to evaluate 5-10x more data points per transaction.finance.yahoo+1

For robotics startups, hardware reliability, safety certifications, and manufacturing scalability take precedence. Due diligence includes extensive testing of physical systems, supply chain analysis, and regulatory compliance verification across multiple jurisdictions.startupgenome+1

Financial and Market Validation

Unit economics analysis has become paramount, with investors requiring clear paths to positive unit economics and sustainable gross margins. For AI companies, this includes detailed breakdowns of compute costs, data licensing fees, and infrastructure scaling requirements.reuters+1

Market validation metrics differ significantly between sectors. AI companies must demonstrate strong customer retention and expansion revenue, while robotics companies need proven pilot deployments and measurable customer ROI from physical implementations.

Risk Assessment Areas

Regulatory and ethical considerations have gained prominence, with AI companies requiring bias testing, privacy compliance frameworks, and algorithmic transparency measures. Robotics companies face additional safety standard compliance, liability coverage requirements, and industrial certification processes.finance.yahoo

Scalability evaluation focuses on infrastructure costs and API performance for AI companies, versus manufacturing scalability and supply chain robustness for robotics firms. Both sectors require demonstration of sustainable competitive advantages and defensible technology moats.

Investment Trends and Strategic Insights

Sector-Specific Opportunities

Deep Tech and Robotics has emerged as the dominant VC sector for the first time, surpassing AI and Machine Learning in consecutive quarters with 6.7% of votes versus 6.3%. This shift reflects investor comfort with longer development cycles and higher capital requirements typical of hardware-focused investments.cdp

Vertical-specific robotics applications attracted the largest investment share in 2024, with logistics (27%), defense/security (20%), and medical robotics (15%) leading funding distribution. This specialization trend indicates investor preference for targeted solutions over general-purpose platforms.therobotreport

Funding Stage Evolution

Mega-rounds have become commonplace even at early stages, with eight deals exceeding $100 million in Q1 2025 alone. Notable examples include Figure AI’s $675 million Series B, Apptronik’s $350 million Series A, and Physical Intelligence’s $400 million round.oecd

funding_examples.csv

funding_examples.csv

Generated File

Pre-revenue valuations remain common for breakthrough technology companies, with investors willing to bet on potential rather than demonstrated revenue streams. However, this trend is becoming more selective, focusing on companies with exceptional technical teams and clear commercialization paths.sganalytics

Geographic Distribution and Market Concentration

North American dominance continues, capturing approximately 70% of AI deal value and maintaining leadership in robotics investment. The US specifically attracts 85.5% of global AI funding, while Europe accounts for only 4% of AI investments.oecd+1

Investment concentration has intensified, with the top 10 AI companies accounting for 51% of total venture investment in the sector. This concentration reflects the winner-take-all dynamics in AI markets and the substantial capital requirements for competitive model development.quickmarketpitch

The convergence of AI and robotics represents one of the most significant investment opportunities in venture capital, with both sectors showing strong growth trajectories and increasing investor sophistication in evaluating technical and commercial potential.